Investor Corner, March 2023

In August 2022, Neil Hoyt - President of Michael Roberts Associates, Inc. created a client presentation entitled, “Why the World isn’t Falling Apart in 10 Charts.” The presentation included a high-level review of the driving forces behind 2022’s market decline. Ultimately, our goal was to communicate 3 core points to our clients – of which this post aims to summarize.

Market fundamentals and valuation can rationally explain 2022’s decline in asset prices.

Higher interest rates are necessary to combat inflation and ultimately benefit bond investors.

Inflationary environments provide a boost to Value equities.

Unlike the endogenous shock that rocked the US economy in 2008, the bear market of 2022 was not the result of moral hazard, rather the decline was due to rising interest rates. For example, higher interest rates will increase the discount rate used when determining present value, thus negatively impacting implied valuation. If valuation multiples are declining and earnings growth remains flat or declines, this will result in a negative price return. In other words, market fundamentals and valuation can rationally explain last year’s decline in asset prices.

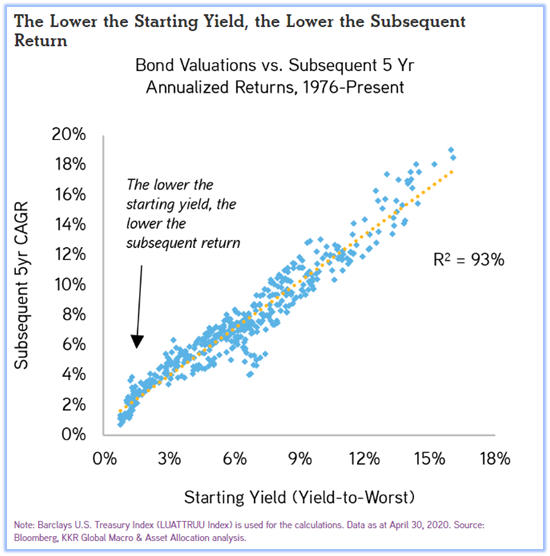

We saw a 450 basis point increase in the federal funds rate in less than 12-months. This resulted in the worst year on record for US bond investors. However, now equipped with higher rates, what does this mean for future bond returns? The best predicator of future bond returns is starting yields. Figure 1.0 highlights the relationship between the US starting yields and future returns. We began 2022 with the US 5-year treasury yield at roughly 1.30%. Fast forward to January 2023, we find ourselves hovering around 4.00%. That’s a massive increase and one that bodes well for future bond investors.

Another interesting datapoint for bonds is outlined in figure 1.1 from JP Morgan’s Guide to the Markets. The chart reviews different hypothetical returns associated with a 1% parallel shift in treasury yields. Given the experiment’s assumptions, and focusing on the US Aggregate Bond Index, a -1% fall in interest rates corresponds with a +10.9% gain for the index. Meanwhile, a +1% rise in interest rates corresponds with only a -1.5% loss. Given the risk/reward outlined in this chart, interest rate risk is much more attractive than 12 or 18 months ago. This is an extremely noteworthy development!

High inflation leads to higher rates, this in turn provides higher starting yields. Higher starting yields boost the expected return of bonds as an asset class. We discussed the fixed income side of the portfolio, but what about stocks? How does high inflation impact our beloved stocks? Well, one area of the stock market that is set to benefit from high inflation is the Value factor. If you’re new to factor investing, you can review some of the basics here.

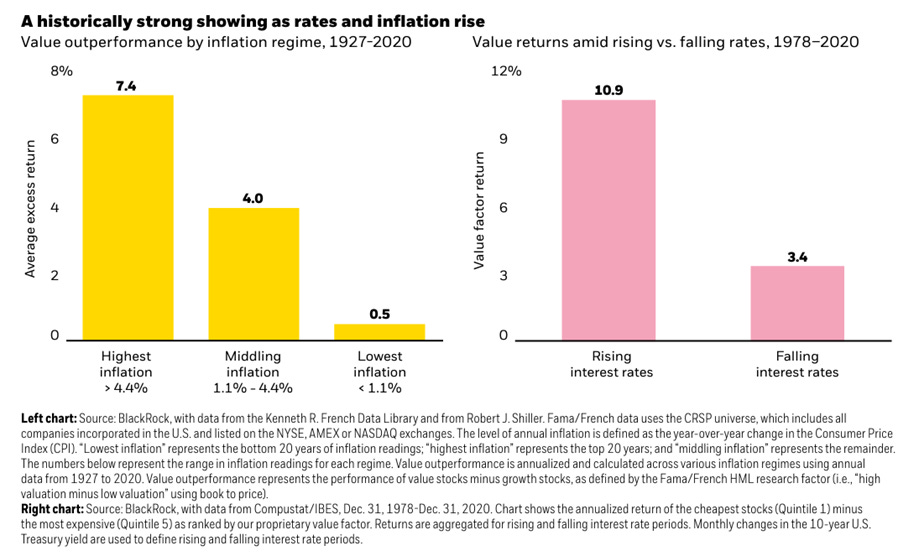

The below chart (figure 1.3) highlights two important pieces of information:

On the left side, the yellow bar chart highlights the Value factor’s average excess return in different inflationary environments.

On the right side, the pink bar chart highlights the Value factor’s return during periods of rising and falling interest rates.

Historically, the highest average excess return for Value occurred during periods with the most inflationary pressure. Additionally, rising interest rates have provided a boost to Value equities. The Value factor is proven to drive stock market returns and continues to demand our attention when constructing client portfolios!

Interest rates are the lifeblood of the economy and therefore heavily influence financial assets. Following a prolonged period of low-to-zero interest rates, it’s important to understand that high inflation demands higher rates. The Fed’s primary tool against inflation is to increase the cost of borrowing via raising the federal funds rate. In theory, when borrowing costs rise, the demand for services, goods and labor will decline. This leads to a slowing in price and wage changes and eventually reduces the inflationary pressure on prices. Inflation is one nasty enemy. Short-term pain in asset prices today, is well worth effectively subduing persistently high inflation tomorrow. For many retirees, high inflation is a much greater enemy than an economic recession. We must keep this in mind when constructing financial plans and portfolios that help us achieve our long-term goals. We hope you found value in this post – if you have questions or would like to discuss in more detail, please reach out and let us know!